Fact Sheet 2: Fractionation: Inheriting Undivided Interests

To Download Adobe Reader software, click here...

To Download Adobe Reader software, click here...

When people pass away without a written will, their land, including any interests in land they have inherited, passes to their heirs under the American Indian Probate Reform Act of 2004 (AIPRA)1. State laws no longer determine how trust or restricted lands pass from one generation to the next for individuals who pass away on or after June 20, 2006.1

AIPRA created a uniform probate code for all reservations.1 Probate is the process by which a court confirms and finalizes the contents of a will. The Act applies to all reservation trust lands1 unless a tribe has a probate code approved by the Secretary of the Department of Interior.

Fractionation

Today, some reservation allotments are co-owned by hundreds of people. This is because

with the passing of each generation, there are an increasing number of heirs who have

inherited undivided interests in the same allotments. This increase in co-ownership is known as fractionation. This fact sheet explains how fractionation results from inheriting interests in allotments.

Allotments and Heirs

Under the General Allotment Act of 1887, each individual tribal member was allotted

land on his or her reservation. As these “original allottees” have passed away, their

single ownership interests have usually been inherited by multiple heirs. Each of

these individuals owns an undivided interest in the entire allotment. The allotment—the land itself—remains undivided (not partitioned),

so that none of the heirs has a right to any specific parcel of land or “piece” of

the allotment.

If you have inherited an undivided interest in an allotment on a reservation, your BIA Individual Trust Interest (ITI) report shows the fractional interest you own. Fact Sheet #4describes where you can get an ITI report, what the numbers in the report mean, and why the report is important to you.

Example: Tessa’s ITI report shows that she owns an undivided interest of 7/15330 in an allotment on the Blackfeet Reservation, 5/288 in an allotment on the Fort Peck Reservation, and 1/432 in an allotment on the Fort Belknap Reservation —all in Montana. She also owns 1/188 in an allotment on the Fort Hall Reservation in Idaho. With this information, Tessa is able to visualize her land ownership.

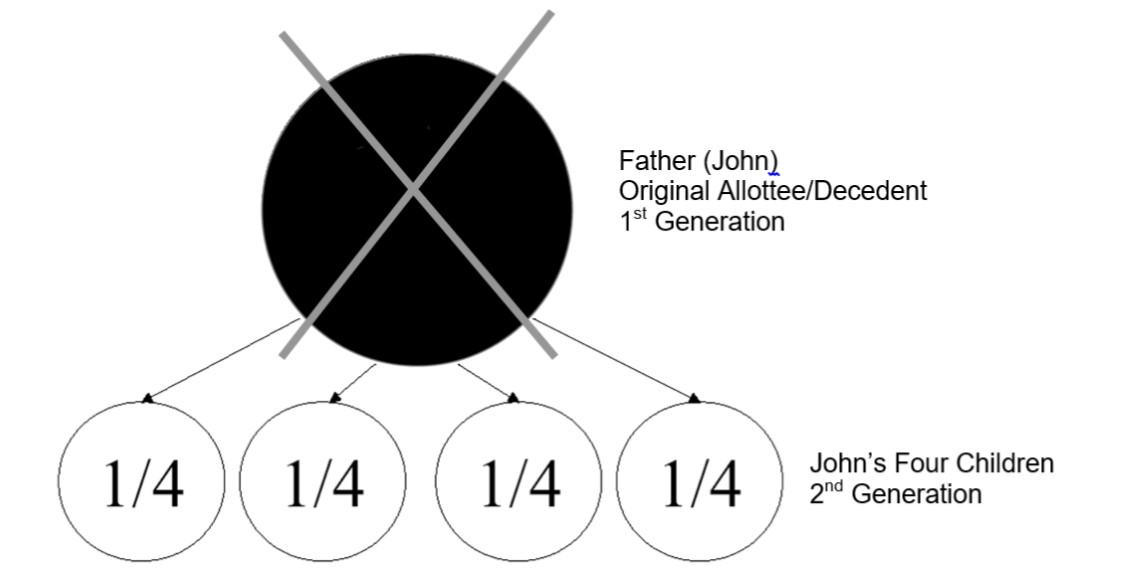

Undivided Interest—Passing From First to Second Generation (Figure 1)

Figure 1 illustrates how an undivided interest could have passed from an original allottee to his/her children (his/her descendants). The legal term for someone who has passed away is decedent.

John, an original allottee, has full ownership in a 320-acre allotment. If John passes away without a surviving spouse or a written will, his four children equally inherit an undivided interest in his allotment. In other words, each of his four children inherit 1/4 (25%) of the interests in the entire 320-acre allotment.

None of the four children owns a specific parcel that he/she can stand on and say, “This part is mine.” What John’s heirs can say is, “I own an undivided interest of 1/4 in the entire 320-acre allotment.”

If someone wanted to lease the land in the allotment, that individual would have to obtain the approval of the majority of the children.

If someone wanted to buy the 320-acre allotment, he or she would have to buy the undivided interest from each child. This could be a problem if the four co-owners do not agree about the sale.

Fact Sheet #4 for an explanation and illustration of how an undivided interest is recorded on an Individual Trust Interest (ITI) report from the BIA. The ITI report shows an undivided interest as both fractional (“FRACTION ACQUIRED”) and decimal (“AGGREGATE DECIMAL”) values.

Figure 1: Undivided Interest in an Allotment Passing From First to Second Generation (John passed away leaving four children)

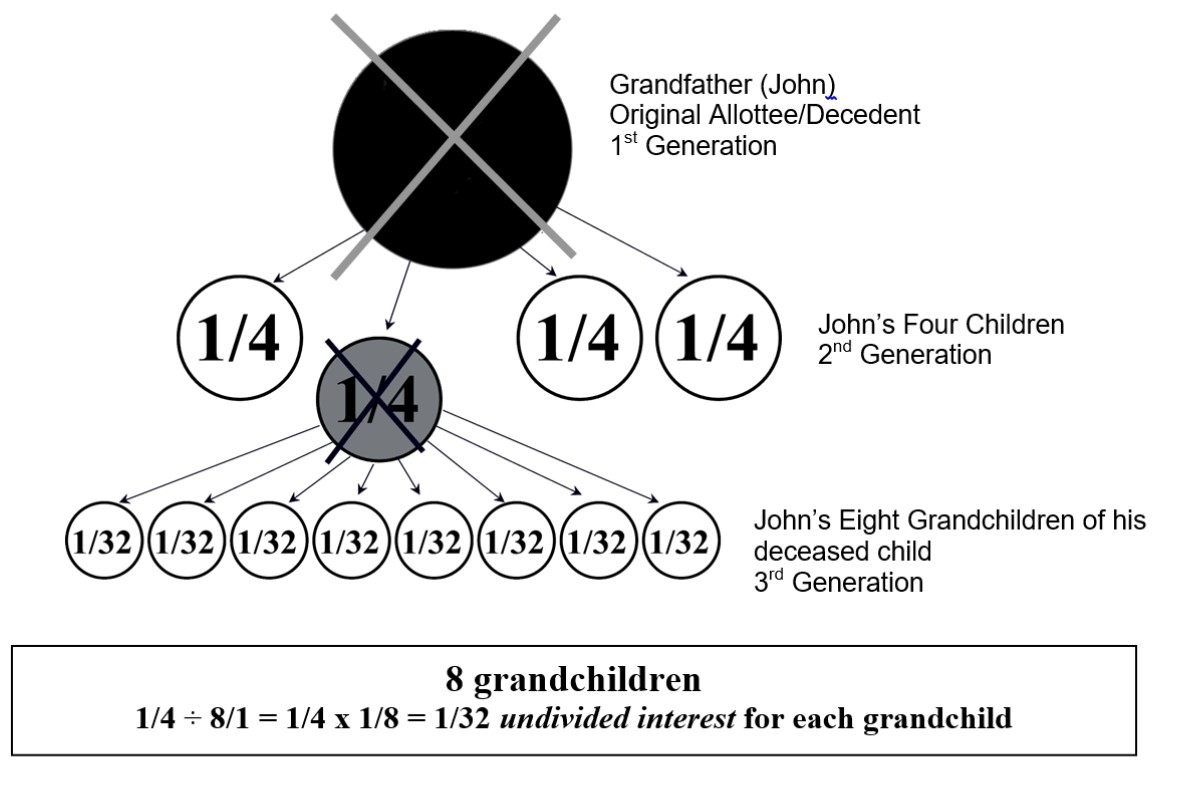

Undivided Interest—Passing From Second to Third Generation (Figure 2)

What happens to the 320-acre allotment when one of the four children who inherited

a 1/4 undivided interest in John’s allotment passes away? John’s child that passes away has eight surviving

children. These eight children are John’s grandchildren.

John’s eight grandchildren equally split the 1/4 undivided interest that their parent inherited from the original allottee, their grandfather, John. Each of these eight grandchildren inherits an undivided interest of 1/32 in the original allotment (1/4 ÷ 8/1 = 1/4 x 1/8 = 1/32).

John’s grandchildren do not own a specific part of the allotment on which they can build a home or any other type of building. What they own is an undivided interest in John’s original allotment. The only way a grandchild could build on the 320-acre allotment would be with permission of a majority of the co-owners’ (the grandchild’s other brothers, sisters, aunts, and uncles).

Undivided Interest—Future Generations (Figures 3-5)

Figures 3-5 show a six-generation example of the inheritance of an undivided interest using values listed on an Individual Trust Interest (ITI) Report from the BIA. Illustrations

are by:

- fractional values (Figure 3, page 4), listed as FRACTION ACQUIRED on your ITI report,

- decimal values (Figure 4, page 5), listed as AGGREGATE DECIMAL on your ITI report, and,

- lease payment values (Figure 5, page 6).

Each figure shows a possible situation. Your ownership of an undivided interest will depend on your family history. That information can be found in your Individual Trust Interest (ITI) Report. Fact Sheet #4, Your ITI Report: How to Read It.

Figure 2: Undivided Interests—Passing from 2nd to 3rd Generation

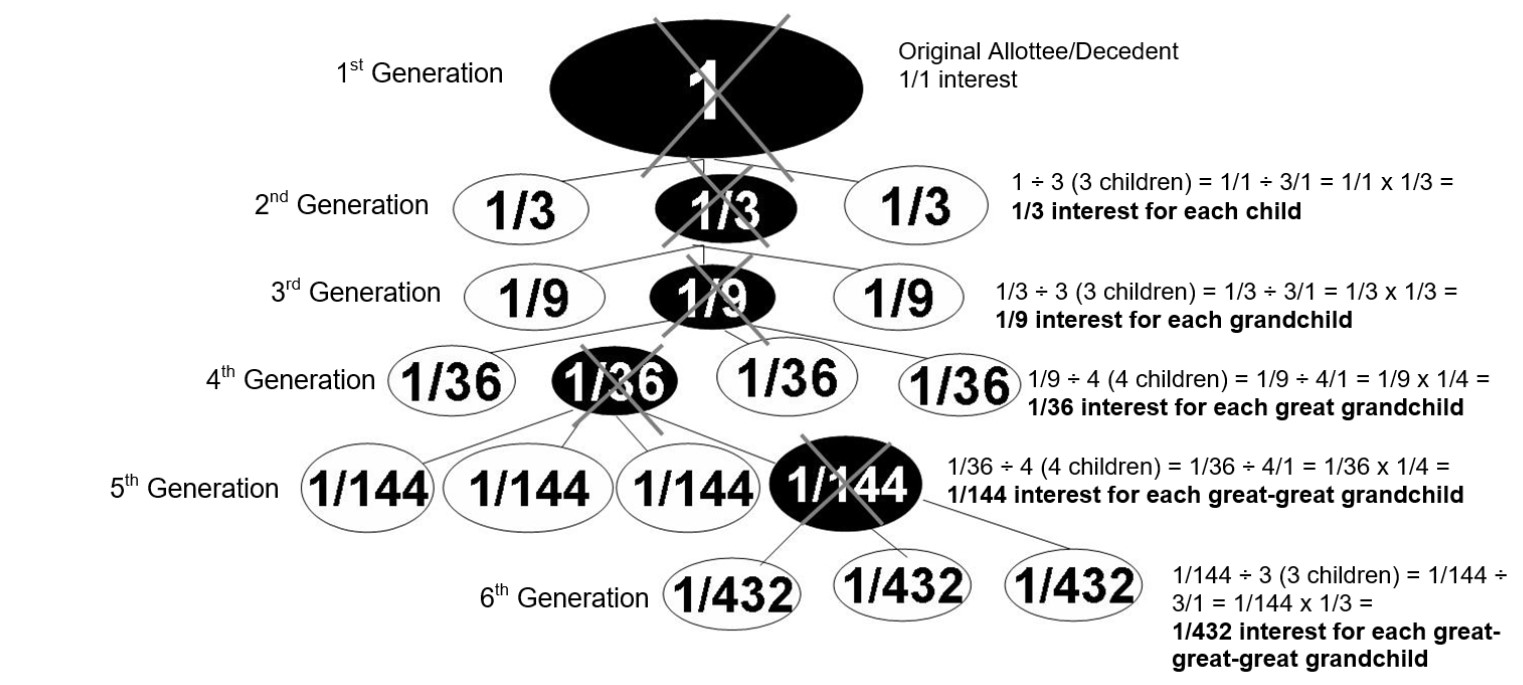

Undivided Interest—Fractional Values (Figures 3)

Undivided Interest—Fractional Values (Figures 3)

Figure 3 shows a six generation example of inheritance of undivided interests expressed in fractional values. On the ITI report this information is found in the

FRACTION ACQUIRED section.

1st Generation. In this example, the original allottee received 320 acres. He had three children who survived him. The value of his ownership is 1 or 1/1 when expressed as a fraction.

2nd Generation. At the original allottee’s passing, each of his three children equally inherited a 1/3 undivided interest in each acre in the allotment. When one of these children passed away, she also had three children who survived her (grandchildren of the original allottee).

3rd Generation. Each of the surviving three grandchildren of the child that passed away equally inherited a 1/9 undivided interest in each acre in the allotment (1/3 of the 1/3 interest in the original allotment). When one of these grandchildren passed away, she had four children who survived her (great-grandchildren of the original allottee).

4th Generation. Each of these four great-grandchildren equally inherited a 1/36 undivided interest in each acre in the allotment (1/4 of the 1/9 interest held by the 3rd generation family member). When one of the great-grandchildren passed away, four children (great-great grandchildren of the original allottee) survived.

5th Generation. Each of the surviving four great-great-grandchildren equally inherited a 1/144 undivided interest in each acre in the allotment (1/4 of the 1/36 interest held by the 4th generation family member). When one of these great-great grandchildren passed away, three children (great-great-great grandchildren of the original allottee) survived.

6th Generation. Each of the surviving three great-great-great grandchildren equally inherited a 1/432 undivided interest in each acre in the allotment (1/3 of the 1/144 interest held by the 5th generation family member).

Although each member of the 6th generation has an undivided interest of 1/432 in the allotment, this does not mean there are 432 owners. There are 13 descendants who share ownership of John’s original allotment ( Figure 3).

Figure 3: Inheritance of Undivided Interests by Fractional Values through Six Generations

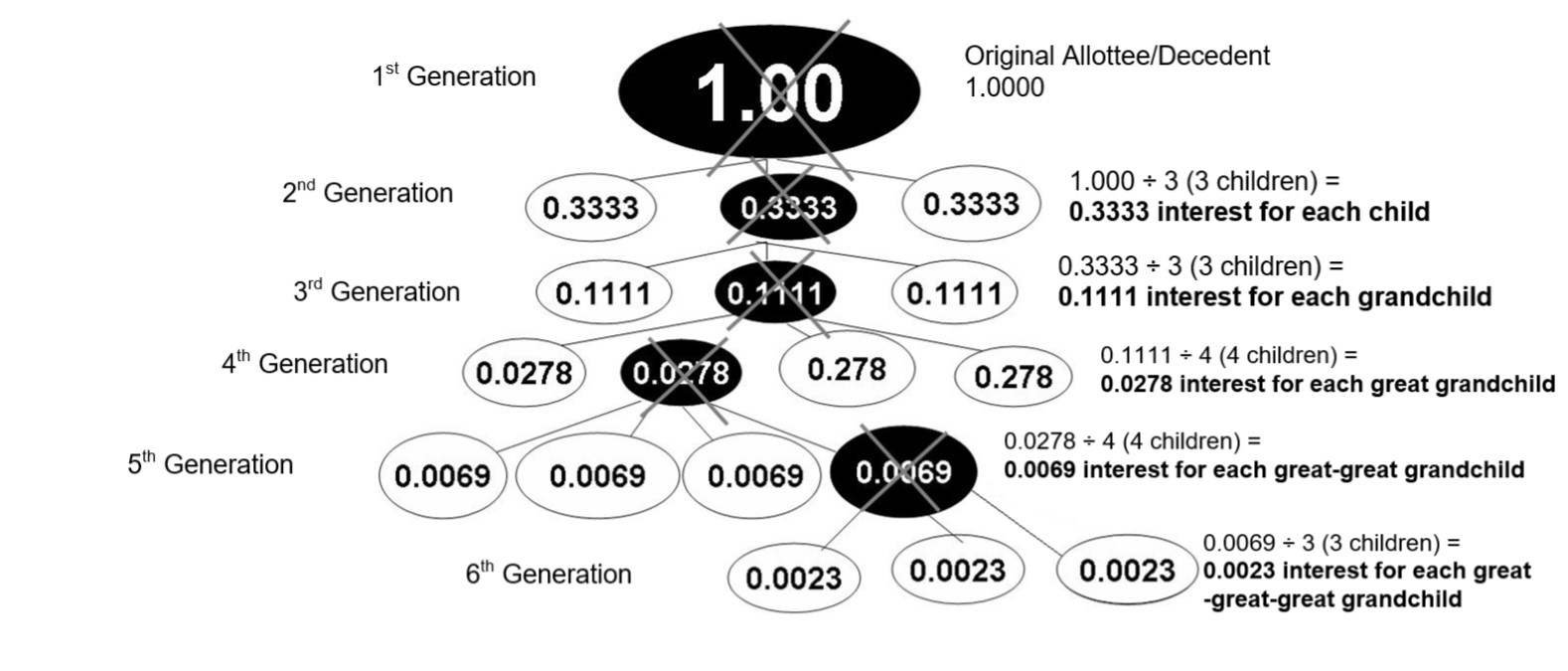

Undivided Interest—Decimal Values (Figure 4)

Figure 4 shows the same six generation example of inheritance of undivided interests described in Figure 3 but expressed in decimal values. Similar information is provided

in the Individual Trust Interest (ITI) Report provided by the BIA in the AGGREGATE

DECIMALcolumn. The only difference is that the ITI report shows ten numbers to the right

of the decimal (for example, 0.1364583333). In Figure 4, the decimal values have

been rounded to four numbers to the right of the decimal.

1st Generation. The original allottee was allotted 320 acres. The decimal value of ownership is

1.00. The allottee had three children who survived him when he passed away.

2nd Generation. Each of the original allottee’s three children equally inherited an undivided interest of 0.3333 in each acre in the allotment. When one of these children passed away,

she was survived by three children (grandchildren of the original allottee).

3rd Generation. Each of these surviving three grandchildren equally inherited an undivided interest of 0.1111 (0.3333 ÷ 3) in each acre in the allotment. When one of these grandchildren

passed away, she left four children (great-grandchildren of the original allottee).

4th Generation. Each of these four great-grandchildren equally inherited an undivided interest of 0.0278 (0.1111 ÷ 4) in each acre in the allotment. When one of these great-grandchildren

passed away, she was survived by four children (great-great grandchildren of the original

allottee).

5th Generation. Each of these four great-great-grandchildren equally inherited an undivided interest of 0.0069 (0.0278 ÷ 4) in each acre in the allotment. When one of these great-great

grandchildren passed away, three children survived (great-great-great grandchildren

of the original allottee).

6th Generation. Each of these three great-great-great grandchildren equally inherited an undivided interest of 0.0023 (0.0069 ÷ 3) in each acre in the allotment.

Figure 4: Inheritance of Undivided Interests by Decimal Values through Six Generations(Rounded)

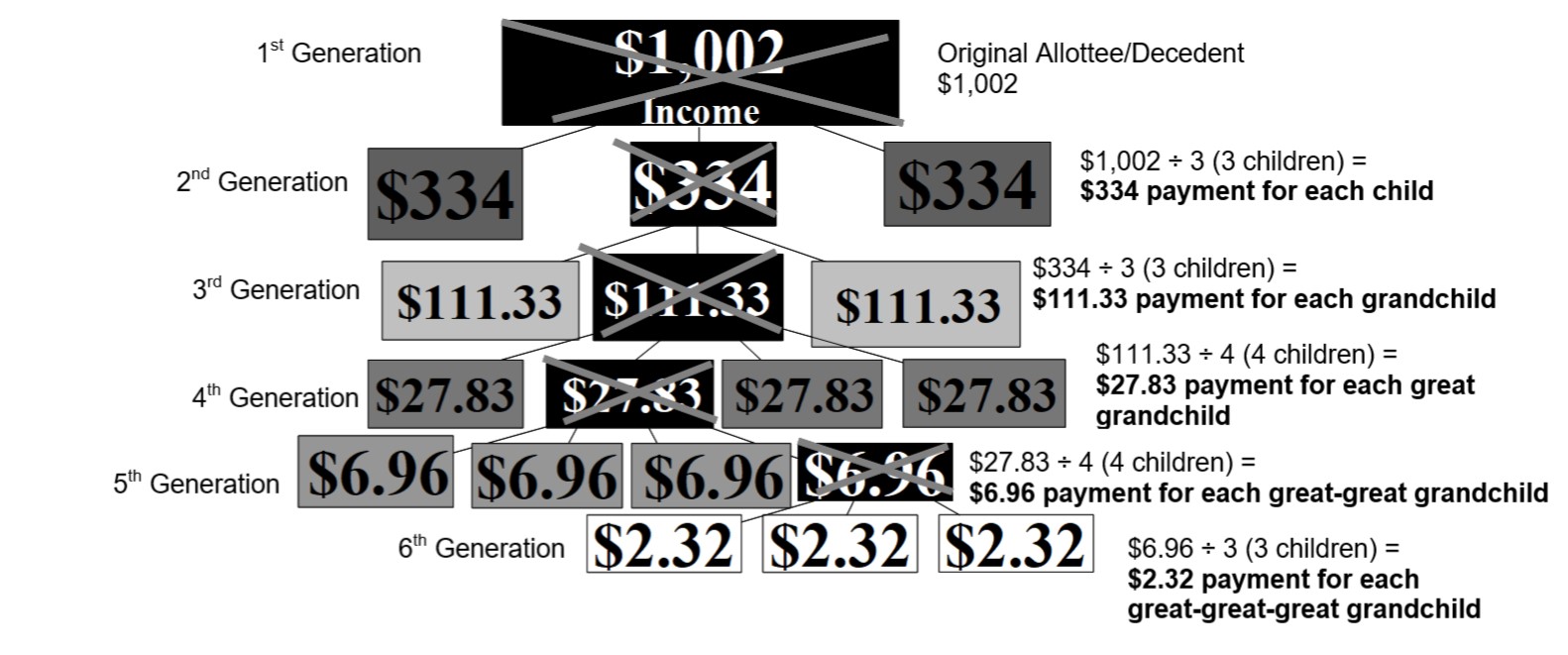

Undivided Interest—Lease Payment Values (Figure 5)

Figure 5 shows a six generation example of inheritance of undivided interests by lease payment values. The lease payment of $1,002 to the original allottee is

reduced to $2.32 for the three members of the 6th generation because of fractionation.

Figure 5 is similar to Figures 3 and 4, but the value of the undivided interest is expressed in a dollar amount of lease payments rather than as fractional and decimal

values.

1st Generation. The original allottee’s 320-acre allotment generated an annual lease income of

$1,002.

2nd Generation. The annual lease payment of $1,002 was equally divided among his three children.

Each received $334 annually ($1,002 ÷ 3 = $334). When one of these children passed

away, her three children survived (grandchildren of the original allottee).

3rd Generation. The lease payment of $334 that would have been paid to their parent was equally

divided among the three grandchildren. Each received $111.33 annually ($334 ÷ 3 =

$111.33). When one of these grandchildren passed away, four children survived (great-grandchildren

of the original allottee).

4th Generation. These four great-grandchildren equally divided the lease payment of $111.33 that

would have been paid to their parent. Each received $27.83 annually ($111.33 ÷ 4

= $27.83). When one of these great-grandchildren passed away, four children survived

(great-great grandchildren of the original allottee).

5th Generation. These four great-great-grandchildren equally divided the lease payment of $27.83

that would have been paid to their parent. Each received $6.96 annually ($27.83 ÷

4 = $6.96). When one of these great-great grandchildren passed away, three children

survived (great-great-great grandchildren of the original allottee).

6th Generation. These three great-great-great grandchildren equally divided a lease payment of

$6.96 that would have been paid to their parent. Each received $2.32 annually ($6.96

÷ 3 = $2.32).

Figure 5: Inheritance of Undivided Interests by Annual Lease Payments through Six Generations

What Can You Do?

Do you own an undivided interest in allotments on several reservations? Do you have problems or potential problems

with fractionation?

Find out by requesting your Individual Trust Interest (ITI) Report from the Bureau of Indian Affairs ( Fact Sheet #4). Your ITI report will show your undivided interest in land as “FRACTION ACQUIRED” (1/10, 1/5, 1/4, for example) and as an “AGGREGATE DECIMAL” (0.0025396825, for example).

To gain a better understanding of how your land may fractionate upon your passing if you don’t write a will, draw a family tree similar to the illustrations in this fact sheet. Use your Individual Trust Interest (ITI) report from the BIA to determine the number of undivided interests you may own ( Fact Sheet #4).

Acknowledgements

We wish to express appreciation to the Montana and Idaho Reservation Extension agents

and Reservation Extension student assistants on the Blackfeet, Fort Belknap, Fort

Hall, and Fort Peck reservations for their assistance in reviewing the fact sheets

and presenting the information on their home reservations. This MontGuide has also

been reviewed with the assistance of students from the Alexander Blewett III School

of Law at the University of Montana.

Co-authors:

Marsha A. Goetting

Extension Family Economics Specialist

Department of Agricultural Economics and Economics

Montana State University

Kristin Ruppel

Department of Native American Studies

Montana State University

This publication was supported by the Community Outreach and Assistance Partnership Program of the Risk Management Agency USDA number 051E08310186.

1 Except Alaska, the Five Civilized Tribes, and Osage.

COPYRIGHT 2021

Montana State University Extension is an ADA/EO/AA/Veteran’s Preference Employer and

Provider of Educational Outreach.