Montana Common Law Marriages and Estate Planning

MT201408HR

Revised September 2024

By Marsha A. Goetting, Ph.D., CFP®, CFCS, Professor and MSU Extension Family Economics Specialist and Keri D. Hayes, MSU Extension Publications Assistant

This MontGuide explores Montana common law marriages from an estate planning perspective.

Topics include a definition of common law marriage, proof of the existence of a common

law marriage, documentation that is necessary for a common law marriage, and inheritance

share for the surviving spouse of a common law marriage.

JOHN AND MARY, AN UNMARRIED COUPLE, LIVED together for 15 years prior to John’s death. They never obtained a marriage license

or had a wedding. John had two children from an earlier marriage while Mary had no

children. They did not have any children together. All property was in John’s name

only. He died without a written Will. Does the property valued at $2 million pass

to John’s two children or to Mary? The answer depends on whether John and Mary had

a common law marriage.

Mary filed in district court as a surviving spouse because she believed she and John

had a common law marriage. If Mary “wins,” she inherits $1,075,000. John’s children

from his earlier marriage inherit $925,000.

Why the difference in amounts? Under Montana law, the estate of a person who dies

without a Will is divided between his spouse and children from a prior marriage. If

Mary is not a “wife,” then all of John’s $2 million estate passes to his children.

John’s two children asserted in district court, “A common law marriage between their

dad and Mary did not exist.” If the children “win,” they will inherit their father’s

estate – all $2 million. Mary inherits nothing. The district court has a decision to make: did John and Mary have a common law marriage?

After the death of one party, there may be confrontations between the “surviving spouse” of a perceived common law marriage and the deceased person’s other heirs – children, grandchildren, parents and/or siblings. An estate plan could help prevent these conflicts and avoid costly court and attorney fees from a contentious court case to decide the existence of a common law marriage.

This MontGuide explores Montana common law marriages from an estate planning perspective.

Topics included are:

- What is the definition of common law marriage?

- What proves a common law marriage?

- What documentation is necessary for a common law marriage?

- What amount does the surviving spouse of a common law marriage inherit?

The MontGuide does NOT examine federal or state rules or common law marriages for the determination of benefits set up by the Social Security Administration, the Montana Workers’ Compensation Bureau, or the determination of income taxes by the Internal Revenue Service, nor the Montana Department of Revenue.

What is a common law marriage?

A common law marriage is one formed without a license and solemnization by a minister,

a priest, a judge of a court of record or by a public official whose powers include

solemnization of marriages (mayor, city judge, or justice of the peace). The State

of Montana recognizes both formal marriages following the marriage statutes and common

law marriages not following the marriage statutes, but nonetheless meet the requirements

in Montana case law. Montana is one of nine states allowing common law marriages.

What establishes a common law marriage in Montana?

The Montana Supreme Court has established three elements for creating a common law

marriage. The party asserting the existence of a common law marriage must prove the

following three elements to the district court.

First, the parties were competent to enter a marriage. The competency requirements for a common law marriage are the same as those in a

traditional marriage. The parties must be at least 18 years old and cannot be related.

Additionally, they must have the mental capacity to enter a marital relationship.

Second, the parties assumed a marital relationship by mutual consent and agreement.

This means the two people expressed their intent to be married to one another. The

mutual consent of the parties does not need to be expressed in any form and can be

implied from the conduct of the parties. The agreement may occur privately without

anyone else present, or it could be seen by many. In Montana two people cannot create

an “unintended” common law marriage.

Third, the parties confirmed their marriage by cohabitation and public repute. Common law marriages confirmed by the Montana Supreme Court typically have focused

on this element. Because these elements cannot be proven immediately, particularly

cohabitation and public repute, the Court does not require the party seeking to establish

a common law marriage to prove all elements of a common law marriage happened instantly.

While cohabitation is one issue the court will consider, it is not the determining

factor. The belief that if a couple lives together for a certain number of years,

such as seven, they automatically have a common law marriage, is incorrect. There

is no specific length of time of living together that automatically creates a common

law marriage in Montana.

To determine whether a couple has held themselves out to the public as married, the

Montana Supreme Court has considered a number of actions including, but not limited

to, exchanging rings, taking the partner’s last name, filing joint tax returns, referring

to one another as husband and wife or as spouses — to themselves, friends, and the

community, and filling out any type of documents or forms with a signature line indicating

“spouse.” Having different last names is not positive proof of whether a common law

marriage exists. Maintaining separate financial accounts or having joint accounts

may not matter.

The best case for common law marriage would be a combination of all these factors.

However, in some court cases, only one or two of the factors existed for a marriage

to be considered common law. The clearer the proof, for example, all neighbors said

they thought the couple was married, they both wore wedding rings, or they had the

same last name, the more likely the district court will rule the marriage as common

law.

Two competent individuals could live together their whole adult lives and never form

a common law marriage. If they never represented themselves to the community at large

as spouses; if they never functioned as if they were a married couple rather than

a pair living together; and if they never said “we are married;” then a common law

marriage does not exist. District courts and the Montana Supreme Court consider all

the facts presented in each case.

What documentation could provide proof of a Montana common law marriage while both parties are living?

A couple wanting to demonstrate a marital relationship by mutual consent and agreement

(the second element of a common law marriage) could complete the Affidavit of Common Law Marriage form from the Montana State Law Library, found in the forms folder (https://courts.mt.gov/forms/marriage). The form is signed by the couple and sworn before a notary public for the State

of Montana. The form states:

"Your signature on this document may be considered proof of a common law marriage. A common law marriage carries the same rights and responsibilities as a solemnized marriage. If you have any questions about the effects of the document, you should contact an attorney.”

The completed form can be used in situations where proof of marriage is needed, such

as applying for Social Security benefits. The affidavit (sworn statement) could also

be used by a surviving spouse of a common law marriage who is applying for appointment

as a personal representative for the deceased’s estate.

The Montana legislature has created another method for documenting a common law marriage.

A couple may file a Declaration of Marriage without Solemnization with the Clerk of

the District Court. The document serves as an official record of the marriage of the

two parties and the date the two agreed they were married. The declaration can be

computer-generated or handwritten. The Montana Judicial Branch has an Affidavit of

Common Law Marriage form, found online at https://courts.mt.gov/Forms/marriage. The Department of Public Health and Human Services has a fillable Montana Marriage

application form nline at https://dphhs.mt.gov/assets/Statistics/VitalStats/MontanaMarriageApplication.pdf. During 2024, the cost to file the forms is $53, the same as a marriage license.

Are common law marriages recognized on reservations in Montana?

Twelve tribal nations are within the boundaries of Montana. These tribal nations govern

seven reservations: Flathead, Blackfeet, Rocky Boy’s, Fort Belknap, Fort Peck, Crow,

and Northern Cheyenne. In addition, Montana recognizes the Little Shell Chippewa Band

as part of the indigenous community. Each reservation has a tribal code either confirming

or prohibiting common law marriages. Individuals should review the most current version

of the tribal code on their reservation to decide whether a common law marriage is

recognized.

Is a Montana common law marriage legal in other states?

A common law marriage recognized in Montana will be accepted by every state in the

nation. Eight other states and the District of Columbia recognize common law marriages

formed within their borders: Alabama, Colorado, Iowa, Kansas, Rhode Island, South

Carolina, Texas, and Utah. Montana also accepts common law marriages recognized in

these states.

Legally, how does a common law marriage end?

A common law marriage is a “real” marriage and requires a legal Dissolution of Marriage

(commonly referred to as a divorce) to end the marriage. The State Law Library provides

the proper forms for ending a marriage in Montana at http://courts.mt.gov/forms/end_marriage.

An attorney should be consulted to ensure the legal rights of each spouse are protected.

Upon separation or dissolution of marriage, the rights and duties of parents of children

are outlined in a Parenting Plan. Montana Legal Services provides the proper forms

for filing a Parenting Plan https://courts.mt.gov/forms/ParentPlan/pp. The legal advice

of an attorney can also be helpful to protect rights of children.

Are children of a common law marriage considered “legitimate?”

Children of a common law marriage are “legitimate” children of the marriage. Even

without a formal or common law marriage, Montana law considers all children “legitimate.”

Children have the same inheritance rights as outlined in scenarios one through six

later in this MontGuide.

Can a spouse in a common law marriage be appointed as personal representative for their estate?

Yes. Each party in a common law marriage can write a Will and nominate the other to

carry out a plan for the settlement of the estate. In Montana, the individual who

performs this function is called a personal representative. The district judge or

the clerk of court makes the appointment based on a priority list in the Montana Uniform

Probate Code (UPC). A person nominated in a Will has the highest priority for appointment

as personal representative. If a common law married spouse dies without a Will, the

surviving spouse has the highest priority for appointment. In performing duties, a

personal representative must follow procedures set out in the Montana Uniform Probate

Code (UPC).

What factors decide the amount of an estate inherited by a surviving spouse in a common law marriage?

The surviving spouse of a common law marriage has the same inheritance rights under

the Montana Uniform Probate Code (UPC) as any other surviving spouse. However, the

amount passing to a surviving spouse depends upon: how the property is titled, whether

there are beneficiary designations on the property, and whether the deceased had a

trust or will.

- How the property is titled. Whose name appears on the real property, checking and savings accounts, stocks, bonds,

and mutual funds? Is the property solely owned? Is the property titled as joint tenancy

with right of survivorship or as tenants in common?For f urt her information, see

the MontGuide Property Ownership: Estate Planning (MT198907HR).

If the property is held in joint tenancy with right of survivorship between the couple, the property passes automatically to the survivor. Proof of common law marriage is not necessary. If the property is titled as tenants in common, each owns an undivided interest in the property. Each can write a will to distribute their one-half interest. - Presence of a beneficiary designation. Did the deceased owner list a beneficiary who was to receive the home or land upon

death on a transfer on death deed (TODD) on real property, payable on death designation

(POD) on bank and credit union accounts, transfer on death registration (TOD) on stocks,

bonds, and mutual funds, and beneficiary designations on life insurance and retirement

accounts? For further information, see the Designating Beneficiaries Through Contractual Arrangements (MT199901HR).

- Presence of a written will or trust. Did the deceased owner write a will? If so, where is it located?

- Other survivors. Did the deceased (person who died) have surviving parents or lineal descendants (children, grandchildren, or great-grandchildren)?

The Montana UPC, as outlined in scenarios one through six, provides for the distribution

of a deceased Montanan’s property assuming the person died without a written Will

or trust and that the property was in sole ownership. For further information, see

the MSU Extension MontGuides Wills (MT198906HR), Revocable Trusts (MT199612HR), and Testamentary Trusts in Montana (MT202113HR).

What other factors affect the property Mary inherits from John?

Let’s return to the example of John and Mary, the couple mentioned at the beginning

of this MontGuide, who had lived together for 15 years. When John died, he had a ranch

valued at $2 million. Other factors and “what ifs” affect the distribution of John’s

estate.

Six different family scenarios are described on pages 5–8. Each scenario assumes the

deceased had property titled in one name only, or sole ownership.

What if John titled the property in his name and he had written a Will?

Assume John titled the $2 million ranch in his name only, a sole ownership. He wrote

a Will leaving the ranch to his children. In Montana, a person cannot completely disinherit

a spouse. If Mary proves a common law marriage, she, as the surviving spouse, could

be entitled to an elective share of the augmented estate value. The augmented estate

includes assets owned by the deceased at the time of death, as well as assets over

which the deceased exercised control or enjoyment, and transfers made without consideration

within three years prior to death. This provision is designed to make it difficult

for the deceased spouse to intentionally disinherit a surviving spouse by giving property

away or placing it in a trust shortly before death. The augmented estate includes

probate and nonprobate assets. Further, the augmented estate includes assets owned

by the surviving spouse, as well as assets owned by the deceased spouse.

The elective share of the augmented estate increases depending on the length of the

marriage. If the deceased and the surviving spouse have been married to one another

for 15 or more years, the surviving spouse is entitled to 50 percent of the marital

portion of the augmented assets. The percentage varies depending upon how long the

court decides they were in a common law marriage. For further information, see the

MontGuide Dying Without a Will in Montana: Who Receives Your Property (MT198908HR).

On the other hand, a person can completely disinherit children. If John had written

a Will leaving the ranch to Mary, (whether or not she qualified as a common law spouse),

she would receive the ranch. His children would receive nothing.

What if John titled the ranch in his name and he filed a transfer on death deed on

the property?

In 2019, Montana legislature authorized transfer on death deeds as a way for people

to transfer at death their real property in Montana to one or more designated beneficiaries

without probate. For further information, see the MontGuide Transfer on Death Deeds

in Montana (MT202010HR). From 2007 until October 1, 2019, the term beneficiary deed

was used to transfer real property at death. Those deeds that were recorded appropriately

are still effective even after adoption of the new transfer on death deed statutes.

- Mary as designated beneficiary: If John had the ranch titled in his name only and later filed a transfer on death deed naming Mary as the designated beneficiary, upon his death, the ranch automatically becomes Mary’s. Why? Because the transfer on death deed (TODD) listed her as the designated beneficiary. His children would receive nothing. The TODD is a contract with priority over the Montana intestacy statutes.

- Transfer on Death Deed and a Will: If John wrote a Will leaving the ranch to his two children; they would not inherit it as Mary was listed as the designated beneficiary on the transfer on death deed. A transfer on death deed overrides John’s Will. His children would receive nothing.

- John’s children as designated beneficiaries: If John titled the property in his name

only and later decided he did not want Mary to receive the ranch, he could file a

new transfer on death deed naming his children as the designated beneficiaries. In

this case, the children receive the ranch automatically after his death. This is true

even if John wrote a Will leaving the ranch to Mary. The transfer on death deed overrides

John’s Will.

However, if Mary proves a common law marriage existed, she could claim she was disinherited by John’s transfer on death deed. Under the Montana UPC, she could claim the elective share mentioned previously.

What if John titled the property in joint tenancy with right of survivorship with

Mary?

Under Montana contract law, property titled in joint tenancy with right of survivorship

automatically passes to the surviving joint tenant. Assume the $2 million ranch was

titled in joint tenancy with right of survivorship between John and Mary. Upon the

death of John, the $2 million ranch automatically passes to Mary. John’s children

do not inherit the ranch. The same result would apply to checking and savings accounts

that were in joint tenancy with Mary.

What if John wrote a Will leaving the ranch to his two children after the joint tenancy

with right of survivorship title on the ranch with Mary was formed?

Whether John wrote a Will before or after the joint tenancy was formed doesn’t matter.

The joint tenancy with right of survivorship with Mary overrides John’s written Will.

Upon John’s death, Mary becomes owner of the ranch and any financial accounts that

were also in joint tenancy with her because she was the surviving joint tenant. John’s

children do not inherit any property that John held in joint tenancy with Mary.

What if John titled the property in joint tenancy with right of survivorship with

his children?

Assume John titled his ranch property and financial assets in joint tenancy with right

of survivorship with his children. If Mary proves a common law marriage existed, then

she could claim she was disinherited because of the joint tenancy contracts. She could

claim the elective share mentioned previously.

How is property distributed when there is a common law marriage?

Scenarios one through six describe different family situations. Each scenario assumes

the decedent had property titled in sole ownership.

1. Under the Montana UPC, if the survivor is a common law spouse and the deceased has no surviving descendants (children, grandchildren, great-grandchildren) or surviving parent(s), the surviving common law spouse receives all of the deceased’s estate.

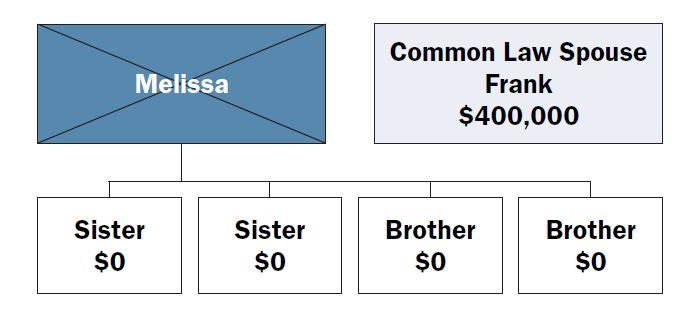

SCENARIO 1a – Common Law Marriage

Melissa and Frank have lived together for seven years. Melissa has property solely

in her name valued at $400,000. While she does not have children or living parents,

she does have four living siblings. Assume Melissa dies without a Will. Frank claims

he is a surviving spouse. If a common law marriage is proven, all $400,000 passes

to Frank. Melissa’s living brothers and sisters would receive nothing.

Legal heir:Frank (Common Law Spouse)

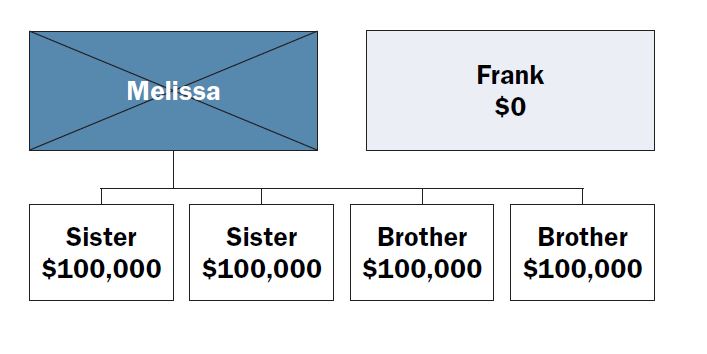

SCENARIO 1b – No Common Law Marriage

However, if the court rules Melissa and Frank did NOT have a common law marriage,

Melissa’s four siblings would inherit $100,000 each. Frank would inherit nothing.

Legal heir:Melissa’s four siblings

2. Under the Montana UPC, if the survivors are a common law spouse and descendants (children) of both the deceased and surviving common law spouse, all of the estate passes to the spouse.

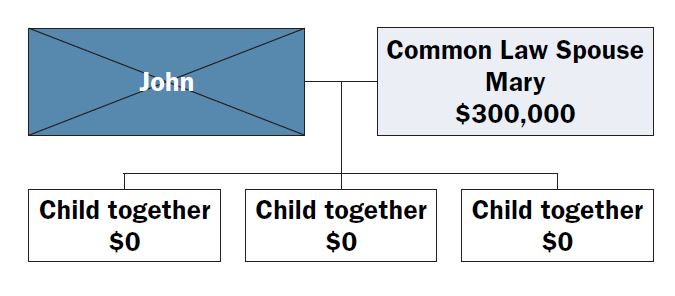

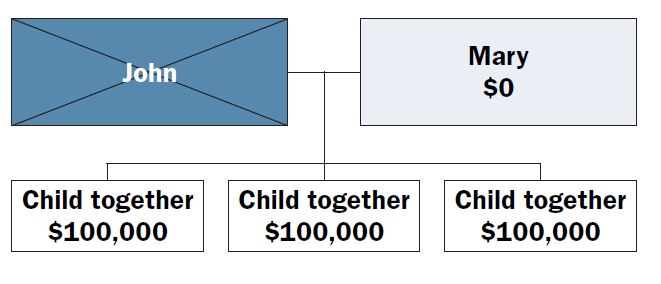

SCENARIO 2a – Common Law Marriage

John and Mary have lived together for 25 years. While they have three children, they

are not married. Neither have children from an earlier marriage. John has an estate

valued at $300,000, titled in his name only. Assume John dies without a written Will.

In district court Mary asserts a common law marriage. If Mary’s claim is proven, all

$300,000 passes to her as the surviving spouse. The children of John and Mary do not

inherit because they are descendants of both John and Mary. Neither John nor Mary

has any other surviving descendants (children or grandchildren).

Legal heir: Mary (Common Law Spouse)

SCENARIO 2b – No Common Law Marriage

However, if the common law marriage between John and Mary is NOT proven, all property

passes equally to John’s children (who are the three from his relationship with Mary).

Mary would inherit nothing.

Legal heir: John’s three children

3. Under the Montana UPC, if the survivors are a spouse, (whether common law or formally married) and the deceased’s parents, the estate is divided as follows: the first $300,000 and ¾ of the balance passes to the surviving spouse. The deceased’s parents share the remaining ¼. If the estate is valued at $300,000 or less, the common law spouse receives the whole estate. The parents receive nothing.

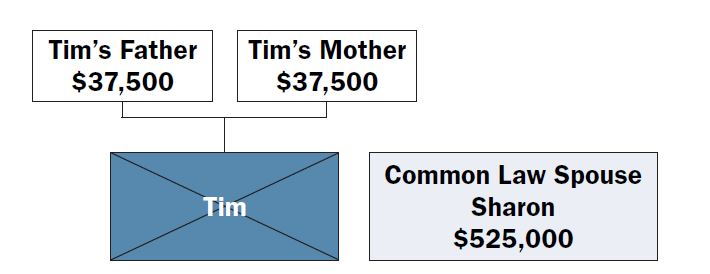

SCENARIO 3a – Common Law Marriage

Tim and Sharon have lived together for 10 years. Tim has property valued at $600,000

titled in his name only. They do not have children. Tim’s parents are living. Assume

Tim dies without a Will. If Sharon proves to the district court that she is Tim’s

common law marriage wife as the surviving spouse, she receives the first $300,000

and ¾ of the balance for a total of $525,000.* Tim’s parents would share the remaining

¼ with $37,500 to each.**

Legal heir: Sharon (Common Law Spouse); Tim’s Parents

*Calculation for Sharon’s share as the surviving spouse

$600,000 – $300,000 = $300,000 balance

$300,000 balance x .75 = $225,000

$225,000 + $300,000 = $525,000

**Calculation for Tim’s parents’ shares

$600,000 – $525,000 (Sharon’s share) = $75,000 balance

$75,000 ÷ 2 = $37,500 for each parent

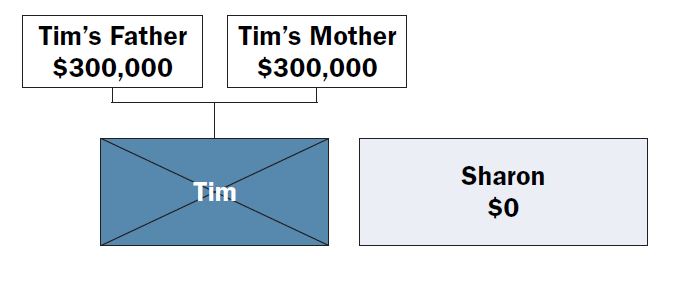

SCENARIO 3b – No Common Law Marriage

However, if the district court decides a common law marriage did NOT exist between

Tim and Sharon, all of Tim’s property valued at $600,000 passes to his parents in

equal shares ($300,000). Sharon would inherit nothing.

Legal heir:Tim’s Parents

4. Under the Montana UPC, if the survivors are the spouse (whether common law or formally married), and descendants (children) of both the deceased and surviving spouse; AND if the surviving common law spouse has one or more surviving descendants (children) who are not descendants (step-children) of the deceased, the common law spouse receives the first $225,000 plus ½ of the balance. The deceased’s children share the remaining ½. Stepchildren do not inherit.

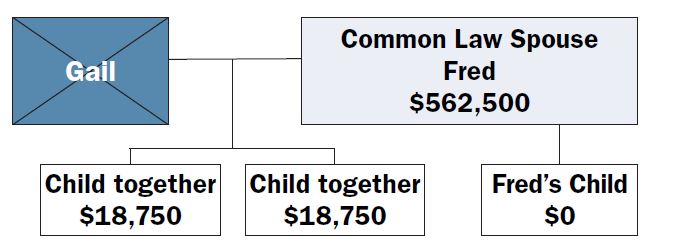

SCENARIO 4a – Common Law Marriage

Gail has an estate valued at $600,000 titled in her name only. Gail and Fred have

lived together for eight years and have two children together. Fred has a daughter

from a prior marriage. Assume Gail dies without a written Will. If Fred proves in

district court that he is the surviving spouse of a common law marriage, he receives

$225,000 and half of the balance for a total of $562,500.* Gail’s children inherit

the remaining portion of the estate, $37,500 with $18,750 to each.** Fred’s daughter

from his previous marriage does not receive any of Gail’s estate.

Legal heir:Fred (Common Law Spouse); Fred & Gail’s children

*Calculation for Fred’s share as the surviving spouse

$600,000 – $225,000 = $375,000 balance

$375,000 balance x .50 = $187,500

$375,000 + $187,500 = $562,500

**Calculation for shares for Gail and Fred’s children together

$600,000 – $562,500 (Fred’s share) = $37,500

$37,500 ÷ 2 = $18,750

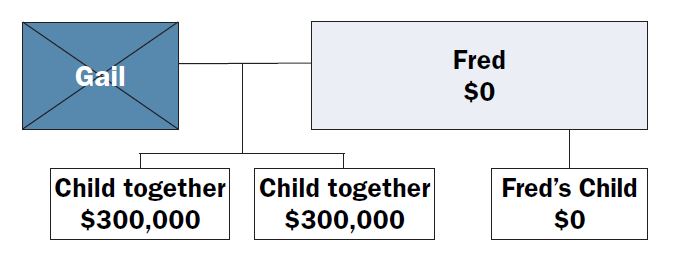

SCENARIO 4b – No Common Law Marriage

However, if the common law marriage is NOT recognized between Gail and Fred, Gail’s

two children from her relationship with Fred would inherit the entire $600,000 with

$300,000 to each. Neither Fred nor his child from a prior marriage would inherit anything

from Gail’s estate.

Legal heir: Gail’s two children

5. Under the Montana UPC, if the survivors are the spouse (whether common law or formally married) and descendants of the deceased who are not descendants of the spouse; the spouse of the common law marriage receives the first $150,000 plus ½ of the balance. The deceased’s children share the remaining ½.

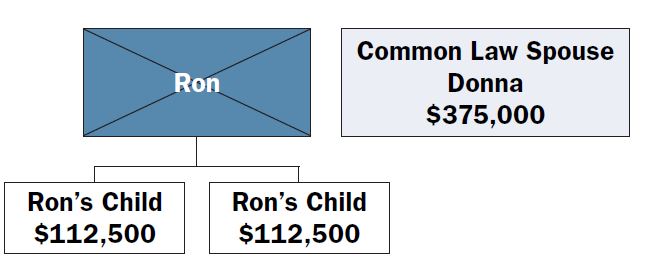

SCENARIO 5a – Common Law Marriage

Ron and Donna have lived together for three years. Ron has two children from an earlier

marriage. Donna has no children. Ron’s estate is valued at $600,000 and titled in

his name only. Assume Ron dies without a written Will. Donna proves she is the surviving

spouse of their common law marriage. She receives the first $150,000 and half of the

remaining balance for a total of $375,000.* Ron’s two children from an earlier marriage

share the remaining balance of the estate of $225,000. Each child receives $112,500.**

Legal heir: Donna (Common Law Spouse); Ron’s two children from his earlier marriage

*Calculation for Donna’s share as the surviving spouse

$600,000 – $150,000 = $450,000

$450,000 x .50 = $225,000

$150,000 + $225,000 = $375,000

**Calculation for shares to the children of Ron

$600,000 – $375,000 (Donna’s share) = $225,000

$225,000 ÷ 2 = $112,500 each to Ron’s children

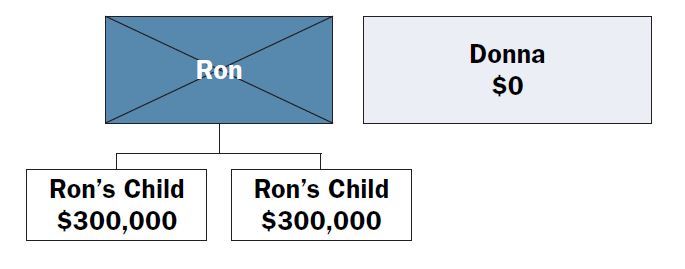

SCENARIO 5b – No Common Law Marriage

If the district course rules Donna and Ron did NOT have a common law marriage, Ron’s

two children share $600,000. Each child would receive $300,000. Donna would inherit

nothing from Ron’s estate.

Legal heir:Ron’s two children from his earlier marriage

6. Under the Montana UPC, if the deceased does not have a surviving spouse, descendants

or parents,

the property passes to the deceased’s brothers and sisters and to their descendants

by representation. By representation means the descendants take the share the parent

would have received had the parent lived.

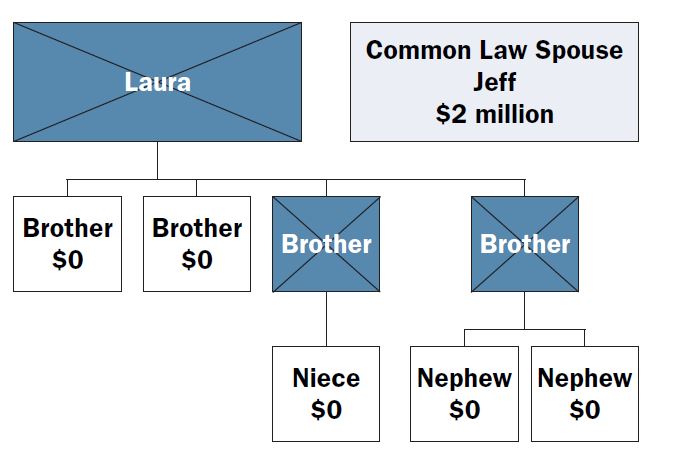

SCENARIO 6a – Common Law Marriage

Jeff and Laura have lived together for 12 years. Laura has a $2 million ranch titled in her name only. She does not have children. She has two living brothers, two nephews, and a niece from two brothers who passed away years ago. Assume Laura dies without a written Will. Jeff proves he is a surviving spouse of a common law marriage. He receives the $2 million ranch. Laura’s brothers, nephews, and her niece would receive nothing.

Legal heir: Jeff (Common Law Spouse)

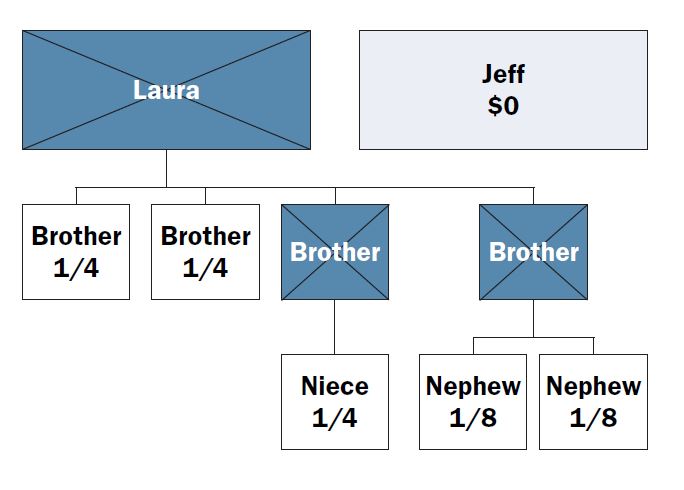

SCENARIO 6b – No Common Law Marriage

If the district court rules Jeff and Laura did NOT have a common law marriage, Laura’s

two living brothers each would receive ¼ interest in the ranch. The other ½ passes

by representation to the children of Laura’s deceased brothers. Her niece would receive

¼ and her two nephews each would receive 1/8 interest in the ranch.

Legal heir: Laura’s two living brothers; two nephews and a niece from two brothers who are deceased

Five people then own the ranch. The new ownership raises important questions. Who is the decision maker for the ranch? Will heirs want their share in dollars? Will one party buy out the others, and at what price?

Summary

Couples living together should be aware that a court could later find their actions

formed a marriage. They should be careful not to hold themselves out as married unless

they are willing to accept the possible legal ramifications.

Common law marriages have estate planning consequences, not only for the couple, but

also for family members. Children may be concerned about inheritance rights if one

of their parents is “living together” with someone who is not their parent. One of

the partners may also wonder if “living together” for a certain number of years proves

the existence of a common law marriage.

If an estate planning goal is to protect the inheritance rights of a surviving spouse,

then a signed Affidavit of Common Law Marriage form is one method of proving mutual consent and agreement. A Declaration of Marriage without Solemnization also serves as an official record of the marriage of the two parties.

If an estate planning goal is to protect the inheritance rights of children, grandchildren,

parents, and siblings, or others, then a pre-marital agreement can be implemented,

a Will can be written, or a trust can be set up. The drafting of a Will or trust and

the related broader matter of estate planning involves decisions requiring professional

skill and judgment, which can be obtained only through years of training, study, and

experience. An attorney is the proper professional to consult about legal documents

such as Wills, trusts, or contracts, and which are best suited for an individual situation.

By waiting until after death to take action, the survivor must prove to the district

court the existence of a common law marriage based on three elements. First, the parties were competent to enter a marriage. Second, the parties assumed a marital relationship by mutual consent and agreement. Third,

the parties confirmed their marriage by cohabitation and public repute. Proof may

vary from case to case depending on the statements of witnesses and what exhibits

are presented to the district court. A wiser course of action for cohabiting couples

is to obtain legal advice while both are alive to clarify their legal status.

Acknowledgments

This MontGuide has been reviewed by members of the following who recommend it’s reading

by those who want to learn more about common law marriages.

- State Bar of Montana— Business, Estates, Trusts, Tax and Real Property Section

- Alexander Blewett II, School of Law, University of Montana

References

- Common Law Marriage in Montana. (December 2019). Montana Lawhelp. www.montanalawhelp.org/resource/common-law-marriage-montana

Montana Codes Annotated. (2023). Family Law Putative Spouse §40–1–404 https://www.leg.mt.gov/bills/mca/title_0400/chapter_0010/part_0040/section_0040/0400-0010-0040-0040.html - Montana Common Law Marriage http://montana.staterecords.org/commonlawmarriage

- Montana Indian Law. https://indianlaw.mt.gov/

- Montana Supreme Court, Montana Judicial Branch, Marriage-Common Law Marriage-Getting Married Court. https://courts.mt.gov/forms/marriage

- National Conference of State Legislatures. Common Law Marriage by State. (2020). www.ncsl.org/human-services/common-law-marriage-by-state

To download more free online MontGuides or order other publications, visit our online catalog at http://store.msuextension.org/ ,

contact your county or reservation MSU Extension office, or e-mail orderpubs@montana.edu.

Copyright © 2024 MSU Extension

We encourage the use of this document for nonprofit educational purposes. This document

may be reprinted for nonprofit educational purposes if no endorsement of a commercial

product, service or company is stated or implied, and if appropriate credit is given

to the author and MSU Extension. To use these documents in electronic formats, permission

must be sought from the Extension Communications Director, 135 Culbertson Hall, Montana

State University, Bozeman, MT 59717; E-mail: publications@montana.edu

The U.S. Department of Agriculture (USDA), Montana State University and Montana State University Extension prohibit discrimination in all of their programs and activities on the basis of race, color, national origin, gender, religion, age, disability, political beliefs, sexual orientation, and marital and family status. Issued in furtherance of cooperative extension work in agriculture and home economics, acts of May 8 and June 30, 1914, in cooperation with the U.S. Department of Agriculture, Cody Stone, Director of Extension, Montana State University, Bozeman, MT 59717.